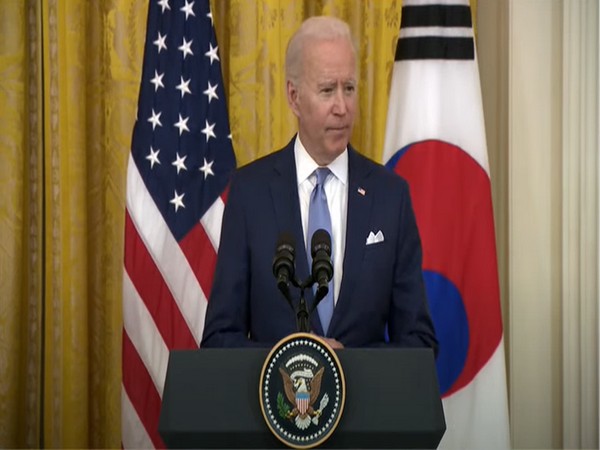

Economic inequality in U.S. result of policy failure, institutional dysfunction

May 22, 2021

Washington DC (USA) May 22: U.S. President Joe Biden's administration has made tackling economic inequality a priority in its economic policy agenda, but a recent report by the Federal Reserve showed just how daunting the task may be.

The report, titled "Economic Well-Being of U.S. Households in 2020" and out Monday, showed economic inequality was most evident among different racial groups and people with varying educational backgrounds.

Less than two-thirds of Black and Hispanic adults were doing at least okay financially in 2020, compared with 80 percent of White adults and 84 percent of Asian adults, said the report, which was based on a survey conducted in November last year. The gap in financial well-being between White adults and Black and Hispanic adults has grown by 4 percentage points since 2017.

Meanwhile, 89 percent of adults with at least a bachelor's degree were much more likely to report doing at least okay financially, compared with 45 percent for those with less than a high school degree. This gap increased to 44 percentage points in 2020 from 34 percentage points in 2019.

Despite the 6.4 percent first quarter gross domestic product (GDP) annual growth that may ostensibly indicate a strong recovery from the pandemic-induced recession thanks to mass vaccination and large-scale stimulus measures, a deeper look at the data will help people realize how imbalanced and volatile the trajectory of the recovery really is.

Jewelry sales in the United States almost tripled in April after having more than doubled in March, according to MastercardSpendingPulse, benefiting from a strong base comparison with April of last year when stores were forced to close.

It's a sign that the rich, whose assets were buoyed by the stock market boom as a result of the pandemic gradually ebbing away, showed stronger willingness to spend their excess fortune.

Just as the wealthy are dazzled by the shining gems, people at the lower end of the income ladder are actually struggling to make ends meet during the pandemic.

As of April, an estimated 8.8 million Americans are behind on their rent, according to the Consumer Financial Protection Bureau. Although estimates vary, the Urban Institute, a Washington think tank, predicted renters may owe anywhere from 13.2 billion U.S. dollars to 52.6 billion dollars in back rent in early 2021.

U.S. households accumulated around 1.6 trillion dollars in excess savings in the period between March 2020 and January 2021, according to an analysis by Oxford Economics. But the top 20 percent of earners -- and to a lesser extent, the second 20 percent -- account for all the current accumulated cash.

The bottom 60 percent, however, have spent most of the savings they accumulated in the pandemic from direct payments and unemployment benefits.

The pandemic may be the direct culprit for the ever faster concentration of wealth in American society, whereas the fundamental reason lies in policy failure and institutional dysfunction.

Stanley Druckenmiller, the billionaire hedge fund manager once recruited by George Soros as a lead portfolio manager, recently lashed out at the Fed, accusing it of exacerbating income inequality by relentlessly resorting to quantitative easing during the pandemic.

"I don't think there has been a greater engine of inequality than the Federal Reserve Bank of the United States in the last 11 years, so hearing the Chairman (Jerome Powell) talking about visiting homeless shelters is very rich indeed," Druckenmiller said while speaking to the University of Southern California Marshall Center for Investment Studies' Student Investment Fund Annual Meeting on a Zoom call.

Those benefiting from money printing are the haves who know how to navigate the market, Druckenmiller said. "I just had the best year I've had in 15 years last year. Everyone wealthy I know is making a fortune and why are we making it? Because this guy (Powell) is printing money like there's no tomorrow. The kids in Harlem in my opinion are not benefiting from money printing but Stan Druckenmiller and other wealthy people are," he said.

Given the Fed's continuation with "the most accommodative on record" even when the pandemic-induced economic emergency "has passed," Druckenmiller said he's betting on inflation, and "inflation is going to hurt poor people a lot more than rich people."

As far as fiscal policy is concerned, the Biden administration has proposed raising the top corporate tax rate and the top personal tax rate as a way to both ameliorate the ballooning fiscal deficit and narrow the income gap.

However, empirical studies have proven that tax hikes have never been a complete cure for economic inequality, though it may temporarily address the problem.

For example, Biden wants to almost double the capital gain tax for taxpayers earning over 1 million dollars, like what Ronald Reagan did in the Tax Reform Act of 1986. Yet, what has happened since the 1980s is that the top 0.01 percent earners' wealth has eventually bounced back, in sync with the stock market rally.

"A wealth tax would do nothing to help low-income earners while hurting the rest of the economy," Ike Brannon, former senior tax policy adviser at the U.S. Department of the Treasury, wrote in an article published last year on Forbes magazine's website. Taxes on the rich, he argued, "invariably reduce savings, investment, productivity, and economic growth" and end up "reducing the wealth of everyone, rich or poor."

"The art of taxation is to pluck the feathers from the goose with the least amount of hissing," Brannon wrote, citing Jean Baptist Colbert, a French statesman during the reign of King Louis XIV. "A wealth tax produces a lot of hissing and no feathers."

Over the last few years, there have been quite a number of acclaimed economists who are searching for remedies for what has been ailing the U.S. economy. Putting aside the solutions, their diagnoses, arguably, all point to institutional dysfunction.

In his 2019 book, "People, Power, and Profits," Nobel Prize-winning economist Joseph Stiglitz argued that the American system of capitalism is failing. A few corporations have come to dominate entire sectors of the economy, contributing to skyrocketing inequality and slow growth, he argued in his book, writing that "while America doesn't excel in growth, it does so in inequality."

"The rules of the game have been stacked in favor of the haves over the have-nots. This has widened economic inequality and increased the concentration of market power among leading firms in every sector, slowing down broad-based productivity growth," read a review of the book by The New York Times.

"These firms and wealthy individuals are converting their riches into political power, further revising the rules to entrench their position at the top. They advocate for tax cuts and the deregulation of everything except intellectual property rights. Anyone who relies on countervailing institutions, like public education, labor unions or social safety nets, loses out," the review said.

Likewise, former Labor Secretary Robert Reich in his 2020 book, "The System: Who Rigged It, How We Fix It," exposed the myths of meritocracy, national competitiveness, corporate social responsibility, the "free market," and the political "center," all of which are used by those at the top to divert attention from their takeover of the system and to justify their accumulation of even more wealth and power.

Reich, who has written extensively since the early 1980s, came to the conclusion that the country's political-economic system is no longer working.

Source: Xinhua